Data-Informed Product Trends for 2022

Products operate in ever-changing markets, as customers surface new needs, as competitors take new action, and as teams discover new technologies. Therefore, for products to succeed, product leaders need to regularly update product strategies and roadmaps. To help inform 2023 annual planning for your products, we’ve compiled a set of key product trends in 2022.

To arrive at these trends, we synthesized the insights that we’ve gained at Product Teacher from running corporate workshops and coaching product leaders, as well as the insights in Amplitude’s Product Report 2022. We hope this deep dive will supplement your strategic decisions and contribute to a data-informed prioritization process within your organization.

Below, we discuss four trends in 2022 that product leaders should keep in mind as they plan for 2023, as well as how they can actionably incorporate these trends into their product strategies:

The case for digital products continues to strengthen relative to other investment areas

Companies with a core competency in analytics and experimentation have continued to outperform competitors

The fastest-growing companies, irrespective of region or industry, are growing rapidly because they address unsolved pain and deeply understand their customers

The fastest-growing industries are those where consumers and providers both face painful manual processes that can be automated or streamlined

Before we continue, keep in mind that every product operates within its own particular context; the trends that we highlight below may not apply to your specific situation.

When reading any industry trend analysis, approach those learnings with a healthy dose of detachment. Your own insight into the needs of your specific customer base are typically higher-priority than global trends, so be sure to triangulate external recommendations against your immediate product context.

With that warning label out of the way, let’s dive into each of the four trends we’ve identified.

Trend #1: The strong case for digital product investment

Global digital product usage grew 16% year-over-year in 2022; this statistic is particularly impressive when we take into account the unprecedented growth that many products had already experienced in 2020 and 2021 due to the pandemic.

This growth in digital product usage is likely not transient - in fact, it appears to be strengthening over time. We believe the following three reasons are driving increasing accelerated growth in digital product adoption over the long run:

Customer choice and competition

Long-lasting support for remote work

Product-led growth

First, customers continue to experience an ever-growing set of options to solve their needs. As their optionality grows, their expectations grow as well.

What expectations do customers have today? They expect speed, convenience, quality, security, flexibility, portability, and personalization - and digital products address all of these expectations in ways that manual services or physical goods cannot address.

Digital products enable customers to solve their pains on their own cadence without having to wait, whereas physical goods require shipping, and whereas services require service provider bandwidth. On top of that, digital products can be enhanced in real-time and customized endlessly for each customer’s specific goals.

Irrespective of your business’s offerings - software, services, or physical goods - customers expect digital experiences that they can access at any time on any device. Whether they’re tracking the shipment of an order, looking for progress updates on a loan application, or booking an appointment with a doctor, more and more customers appreciate the convenience of digital.

Second, business employees are conducting more and more of their work online rather than in-person. Many knowledge-based workforces are now distributed across geographies, as companies have discovered that talent is not restricted to any single location.

Business leaders have learned that COVID is not a short-lived phenomenon but rather a long-lasting force; with this constraint in mind, many leaders have embraced hybrid work and remote work. In these new working configurations, companies have prioritized the purchase of B2B productivity software to drive effective collaboration and decision-making across geographies and time zones.

As more employees get used to asynchronous work, they will increasingly prefer this configuration and demand it from their employers. McKinsey has found that 52% of workers prefer hybrid work and that 11% of workers prefer fully-remote setups, with 30% of workers planning to quit if moved back to colocated working setups.

Third, companies have discovered the value of product-led growth (PLG), which simply means using the product itself to drive company growth across customer acquisition, retention, and upsell. Sales, marketing, and customer success objectives can all be achieved through the product itself, rather than solely achieving these goals through operations.

One benefit of PLG is that it scales indefinitely once a given product workflow has been built. As an example, consider product demos. Companies that use PLG are no longer bottlenecked on the calendar availability of their salespeople to give product demos when prospects are empowered to access interactive demos from within the product itself.

Furthermore, McKinsey has identified that B2B buyers increasingly prefer self-service; in fact, a majority of buyers prefer self-serve across every stage of the customer decision making process, including research, evaluation, initial purchase, and renewals.

Therefore, to meet changing customer preferences and to enable higher-leverage use of employee time, companies increasingly prioritize product-led growth initiatives.

Counterintuitively, some of the highest-value ways to accelerate sales, marketing, and customer success is not to increase manual operations bandwidth in these departments. Instead, by empowering these departments to partner with product management, engineering, and design to craft product-led experiences, business leaders can drive long-term sustainable growth.

Given that product growth will continue to strengthen over time, companies should seriously invest in digital products. In fact, as inflation continues to sink in over the course of 2022, and as countries experience a slow-down in their economies, product initiatives are a valuable way to achieve outsized returns on investment across all departments.

At Product Teacher, we’ve seen record numbers of organizations reach out to ask us how to turn their service offerings into scalable digital product offerings. We’ve also seen increased demand in hiring for senior product talent across companies of all sizes, even in the face of broad layoffs in tech. These two patterns suggest that the case for digital product investment will continue to snowball over time.

To incorporate this trend into your 2023 strategies as a product leader:

Identify complementary digital offerings for physical goods or services (if any)

Create team-based collaboration workflows if you own a productivity product

Partner with sales, marketing, customer success, and other ops-heavy teams to productize bandwidth-intensive workflows

Trend #2: Analytics as a core competency

Across verticals and company sizes, businesses have continued to invest in analytics as a core competency for four reasons:

Customer retention

Customer acquisition

Business agility

Employee collaboration

First, as customer choice continues to grow, and as competitors continue to innovate, many businesses have prioritized customer retention as their top focus in 2022. In Amplitude’s report, 58% of surveyed product professionals shared concerns about customer churn, and customer retention has leapt to the top of many product roadmaps.

After all, a retained customer is worth much more than a newly acquired customer, as retained customers already understand the value proposition of your offerings; therefore, preventing customer attrition is top-of-mind for both product leaders and business executives.

Analytics enables companies to identify their current retention patterns and to address the leakiest steps. By doing so, companies create long-term value for their customers; by enabling their customers to grow and succeed, businesses grow in tandem through upsells and referrals. Companies equipped with an analytics core competency will more drive customer retention, whereas companies without analytics strength may falter in pulling this strategic lever.

Second, customer acquisition remains a key priority for businesses to obtain market share and access new markets for sustained long-term growth; after all, retention without net-new acquisition is stagnation.

Yet, without clear analytics, businesses can struggle to optimize their marketing spend. By leveraging acquisition analytics, businesses can identify which acquisition channels are performing well, and which acquisition channels need to be refined or deprioritized.

With sufficiently fine-grained analytics, companies have the ability to identify which campaigns and which initiatives to further invest in, as well as segment their results by buyer persona. These capabilities are invaluable for businesses of any size in any industry.

Third, analytics enables businesses to nimbly adapt to changing market conditions. With analytics in hand, product leaders can quickly update their understanding of customer needs and markets, test their hypotheses through rapid low-cost experimentation, and swiftly align their product strategies to maximize fit.

2022 has proven to be a volatile year, given surprises like the war in Ukraine, global supply chain issues, inflation, changes in workforce patterns, and changes in consumer preferences. The product organizations that have invested in analytics as a core skill have been able to react quickly, whereas less analytically-equipped companies have struggled to update their approach.

Due to this increased volatility, we’ve seen this increased focus on analytics competency through our own product management training practice at Product Teacher. One of the most popular workshops that product organizations have requested from us this year is our “analytics for product managers” workshop.

Finally, analytics is one of the secret sauces to effective employee collaboration. Rather than letting traditional business intelligence (BI) teams serve as gatekeepers of valuable data and insights, modern companies have democratized their internal product data through the analytics platforms that they’ve elected to use.

When companies select analytics platforms that enable teammates to create sharable dashboards and to collaboratively write executive reports, companies move faster using more accurate information to inform their next steps.

These attributes empower every team and every function to access the data they need to make a well-informed decision, which means fewer bottlenecks on executive bandwidth and increased velocity from decentralized decision-making.

That said, while companies are actively strengthening their core competencies in analytics, they must take care to pair this data-oriented mindset with customer empathy.

Many companies fall in the trap of gathering terabytes of data and running hundreds of person-hours of analyses, without taking the time to deeply understand which customer pain they seek to solve.

In other words, endless A/B testing can wind up causing companies to fall prey to incrementalism, causing products to fail to meaningfully unlock unique new value.

Customer-centric analytics enables companies to succeed. By starting from customer interviews, inbound customer feedback, product analytics data, and user surveys, companies can identify the top unaddressed pain points that their customers have. Then, leveraging this insight, they can quickly iterate on scalable, unique solutions that address those pains.

To incorporate this trend into your 2023 strategies as a product leader:

Implement an analytics stack if you don’t have one in place yet

Expand internal user access to data, so you can enable teams from a variety of functions to gather their own insights

Run data-informed experiments on customer retention and customer acquisition

Use behavioral segmentation to identify key cohorts that you can further optimize

Trend #3: Fast-growing companies combine data and empathy

In venture capitalist Marc Andreessen’s well-known essay on product/market fit, Andreessen identifies that markets matter more than products or teams. Yet, in reviewing Amplitude’s compilation of the companies that achieved the highest monthly active user (MAU) growth in 2022, we found a surprise: the top performers were not operating in the same markets.

In other words, irrespective of the industry vertical that you operate in, you can successfully carve out a niche that creates long-term customer value and investor value.

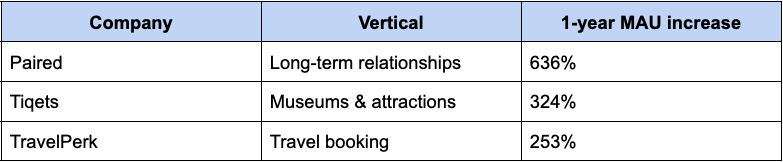

Below, we share nine top-performing companies across three regions: North America, Europe, and Asia-Pacific. For the full list of the 30 fastest-growing companies in the world based on Amplitude’s data, access the full report here.

North America

Fast-growing companies in North America, as identified by Amplitude data

Europe

Fast-growing companies in Europe, as identified by Amplitude data

Asia-Pacific

Fast-growing companies in Asia-Pacific, as identified by Amplitude data

Looking at these nine different companies, we see that the opportunity for outsized growth exists even during turbulent times. In fact, many of the most successful companies in the world were founded during recessions and economic slowdowns.

Even more interestingly, many of the verticals that these companies operate in could be considered “saturated.” For example, the calendar space is a mature market. Yet, Motion identified a uniquely differentiated value proposition for its customers.

And, we see that success can be achieved across a variety of industries and regions. In each region, the top performer grew by more than 600% within a single year.

Furthermore, companies can achieve success in both B2B distribution models as well as B2C distribution models. For example, Motion, Magic, and TravelPerk all won in the B2B space, whereas Found, Paired, and onthelook won in the B2C space.

On top of that, while these businesses relied on analytics and experimentation to execute, they also revealed a deep focus on solving real customer pain at scale.

Quotes from the leaders of these fast-growing businesses reveal a thought-provoking mindset: analytics is the starting point for identifying growth opportunities, but customer empathy and customer discovery is the engine for crafting winning solutions within these opportunities.

To incorporate this trend into your 2023 strategies as a product leader:

Encourage your analytics teams and your user research teams to collaboratively build on each other’s insights

Make time and space for your product trios (product management, design, engineering) to explore customer needs that may not yet be represented on existing roadmaps

Don’t assume that a mature market represents full saturation, as there’s always room for discovering unaddressed pain

Trend #4: Fast-growing industries eliminate low-value tasks

Every product leader seeks to maximize upside and minimize risk. When product leaders have insight into growth rates and trends in adjacent verticals, they can draw from the best practices of each industry to identify how to further optimize their own products, as well as gain inspiration for which new business lines to launch.

The full Amplitude Product Report 2022 contains analyses on 12 different industries, including key statistics like growth rates and benchmarked conversion rates. In our discussion, we’ll focus on three of these twelve industries: fintech, traveltech, and healthtech.

Each of these three industries experienced more than 20% year-over-year growth in monthly active users across digital products. Specifically:

Fintech grew by 21.8% over 12 months

Healthtech grew by 32.1% over 12 months

Traveltech grew by 33.6% over 12 months

What connects these three industries together? In each industry, both consumers and service providers were used to cumbersome manual processes. But, once industry leaders were able to use digital experiences to streamline and automate these workflows, they were able to unlock explosive sustained growth.

In fintech, service providers can now enable their customers to get loans, open accounts, and more - on their own time, on any device, without needing to take time off of work to visit a bank. And, this enables the employees of service providers to focus on delivering the best possible end-to-end customer experience, rather than struggle through manual workflows.

That’s why Blend, a fintech product, grew 5% in mortgage originations in 2022 even though the mortgage industry as a whole shrunk by 37% during the same time period. Blend’s digital products empowered service providers and consumers alike, enabling it to grow even in a shrinking market.

These same patterns apply in healthtech and telehealth as well. Consumers were used to picking up the phone to find new healthcare providers, to book appointments, to validate insurance, and more.

But through healthtech, consumers can easily get prescriptions for their needs without needing to schedule an appointment, and they can easily coordinate their own care across multiple clinics or specialists. Once consumers are empowered to self-serve, healthcare bandwidth frees up significantly, enabling staff to focus on patient health rather than manual paperwork or low-value tasks.

Similarly, when it comes to travel, consumers are used to having to look across a variety of sources to figure out the logistics for their trip. And, service providers are used to operating call centers to answer consumer questions as they come up. But, this status quo creates pain on both sides of the market.

Traveltech is growing rapidly because it gives consumers more choice, more flexibility, and more empowerment to self-serve. By doing so, it also removes many low-value tasks from service provider employees, enabling them to focus on the best possible end-to-end customer experience, which leads to long-term customer retention and positive word-of-mouth.

To be clear, 2022 did not benefit all verticals indiscriminately; opportunities are not gifts. As an example, K-12 education did not experience double-digit product growth in 2022.

While K-12 education had seen 40%+ MAU growth in a single month from August 2021 to September 2021, nearly all those growth gains had been fully erased by August 2022.

In sharp contrast, in the continuing education space (e.g. career coaching, language classes, etc.), MAU growth skyrocketed by 45%+ within a year.

This growth was possible because digital learning products enable educators to scale in a way that they could not have previously achieved on their own. They can teach once and serve infinitely many students, rather than being trapped into manual workflows that require their ongoing bandwidth to support.

As Product Teacher operates in the continuing education space, we can validate these trends. We’ve seen an increase in student demand for on-demand video courses and a decline in interest for cohort-based live classes.

One key problem with cohort-based classes is that they force students to attend at a specific time. If students miss a session, they permanently miss out on that knowledge. Meanwhile, on-demand classes enable students to learn on their own time and to refresh their knowledge when they need it the most.

That explains why product managers at Google, Amazon, Microsoft, and other leading tech companies have increasingly elected to upskill their talent through flexible self-serve video courses - they don’t need to take time off from the job to invest in key capabilities.

To summarize, many of the fastest-growing industries in 2022 were once sleepy verticals that experienced significant pain and friction on both the consumer side and the provider side. When companies empower consumers with choice and flexibility through scalable digital experiences, they also unlock value for providers, leading to a virtuous cycle of growth.

To incorporate this trend into your 2023 strategies as a product leader:

Identify ways to enable consumers to have massively more choice and flexibility than they currently do

Find ways to streamline workflows and automate away low-value tasks for the people who provide services to customers

How 2022 trends may influence the 2023 product landscape

As a quick refresher, these four trends left their mark on 2022:

Digital products are increasingly more attractive investments for companies

Analytics and experimentation is a core competency for leading companies

The fastest-growing companies addressed the unsolved pain of their customers

High-opportunity industries are the ones with many manual workflows that can be automated or streamlined

With these four trends in mind, what should we qualitatively expect in 2023? At Product Teacher, we expect the following three phenomena to happen in product management:

Increased product-led growth

Reactive product strategy

A wave of new product opportunities

First, we expect that more and more product teams will invest in product-led growth alongside their cross-functional counterparts. As inflation continues to rise, customers want to see the value of the product for themselves first, rather than needing to speak to sales teams or rather than reading through marketing collateral.

Operations-oriented teams like sales, marketing, and customer success will advocate for more product-led experiments and more data analytics, rather than adding more headcount to achieve their objectives. By doing so, they will serve customers more deeply, in a more targeted way, unconstrained by employee bandwidth.

Second, we expect that the winning product strategies of 2023 are unlikely to be static; that is, a predetermined product strategy is unlikely going to last throughout the year, and reactive product strategy will likely drive better ROI than top-down executive-dictated approaches.

In our experience coaching empowered product teams, we’ve found that the best-performing products are those that aren’t married to a single monolithic strategy. Instead, when product teams commit to agile customer discovery and technical exploration, they find novel product strategies that demonstrate stronger fit with changing market conditions.

To be clear, we don’t advocate for a lack of strategy - rather, we advocate for conditional strategy where product teams clearly identify multiple possible paths, with each path tied to specific market conditions. As different market conditions come into effect, product teams can then swiftly adjust their chosen path to stay ahead of the curve.

Executive teams should embrace the mentality of conditional strategy, rather than banking on the certainty of a single company-wide approach. We know that the world is only moving faster over time, and that changes are happening faster than any single person can comprehend; empowering product pods to lead their own adaptive micro-strategies enables organizations to flexibly serve the highest-value pain points of their customers, even if customer pains shift from month to month.

By leveraging analytics, experimentation, and qualitative customer research, modern product teams can spin up new strategies much more quickly than traditional competitors might, which means that they’ll be better equipped to address changing customer needs that would otherwise be left unsolved by others in the market.

Third, we expect a large wave of unlocked product opportunities in 2023. Many large companies (e.g. Meta, Twitter, TikTok, etc.) are cutting back on R&D spend and rightsizing headcount in 2022, which means that a variety of pain points will not be addressed by large companies.

Keep in mind that large companies can only execute on large opportunities - but, there are many viable small opportunities that startups can capture now, enabling them to grow them into large opportunities in the future.

If you’re working in a small startup, now is the time to lean into customer discovery to launch new product offerings. In “good times,” many product teams can afford small, incremental product enhancements on existing offerings. In “lean times,” an incremental approach means a lack of differentiation - and in situations where customers seek to tighten their belts, this approach can prove lethal to a startup.

To be clear, we don’t advocate for “solutions in search of a problem” - blindly applying technology trends rarely addresses the real needs of customers. Instead, we advocate for taking large targeted bets with customers who are in deep pain.

Customers are more likely than ever to agree to co-build solutions with you, especially when no one else is building for them. By committing to tight feedback loops with pilot customers, product teams can launch products that unlock differentiated value as a beachhead for future growth, upsell, and referral when the “good times” roll back around.

Recommended next steps for 2023

Based on the synthesis we’ve provided above, we broadly recommend the below next steps. That said, remember that external recommendations are not directives - consider each recommendation using the lens of your specific product context, rather than taking these recommendations as ironclad guarantees.

Product teams should advocate for more aggressive company allocation for upcoming roadmaps. The team from Amplitude shares, “With so much unknown about the economy, businesses are doubling down on product-led growth to make more cost-effective investments. Product-led growth remains a winning strategy for businesses looking to retain customers in increasingly crowded fields.”

To help back up the business cases for these kinds of allocations, consider analyzing market reports such as Amplitude’s Product Report 2022 or leveraging your product analytics data to surface more insight.

While advocating for more aggressive product investments, product teams should also remember to invest in their own talent. As each product team grows in scope and onboards new talent, their skills can drift away from market needs. Product teams can benefit from leveraging external trainers to accelerate their teams and unlock new value for their customers.

And, if you’re an individual contributor product manager, keep in mind that your roadmap can only be as strong as your own skills. Consider investing in your own growth by using your professional development budget, especially if your budget expires by the end of the year.

2023 will doubtlessly be a year full of exciting new challenges and shifts in the market. We look forward to seeing how product teams seize these opportunities to create positive value for their customers and their investors!